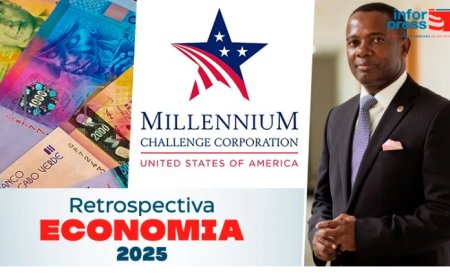

Cape Verde's banking sector reaches record profit of 6.1 billion escudos in 2024

Cape Verde's banking sector recorded record profits of 6.1 billion escudos in 2024. There was growth in loans, deposits and solvency, despite the rise in non-performing loans. The figures were released by the Bank of Cape Verde.

The Cape Verdean banking sector recorded, in 2024, record profits of 6.1 billion escudos, according to data released by the Banco de Cabo Verde (BCV) and consulted by the Lusa agency this Tuesday.

This result represents a growth of 16% on the previous year, with the sector maintaining a stable performance in the return on equity, which remained at around 16%.

The solvency of the sector also strengthened its robustness, with the ratio growing slightly and standing at 24%, well above the regulatory minimum of 11.25%.

Loans granted by Cape Verdean banks reached a new all-time high, totaling 158 billion escudos, an increase of 5% compared to 2023. However, the volume of non-performing loans increased by 14% to 12 billion escudos, which raised the default rate to 8% of the total loan portfolio. Even so, the performing loans accounted for 88% of the total portfolio.

With regard to liquidity, banks closed the year with 280 billion escudos in deposits, reflecting an increase of 7% compared to the previous year, and demonstrating the confidence of depositors and the strengthening of the institutions' financial resource base.

Currently, the banking sector in Cape Verde is made up of eight banks with general authorization, operating in a financial environment marked by stability and sustained growth.