INTERVIEW:Consultant proposes turning migrants' remittances into a public-private asset

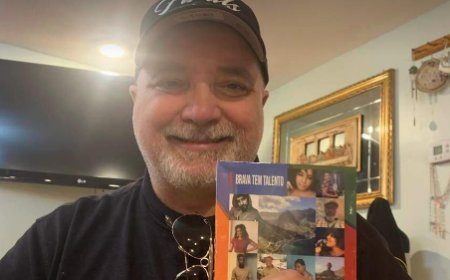

Miguel Sousa, a consultant to the Ministry of Communities, argued that remittances from Cape Verdeans abroad should be recognized as a privately-owned public asset, allowing for their sovereign management and use as a driving force for the country's development.

Miguel Sousa made these remarks in an interview with Inforpress, while taking stock of the International Congress of Cape Verdean Executives and presenting the results of the event, promoted by the International Organization of Executives in partnership with the government, from 15 to 17 October, in Praia, under the slogan "A dialogue between the country and the diaspora".

According to Miguel Sousa, remittances represent one of Cape Verde's largest flows of foreign currency, supporting thousands of families and contributing to the country's economic stability.

"Remittances are an expression of solidarity and trust, but they can also become instruments of collective investment. The creation of a public-private remittance asset would make it possible to unite the state, the private sector and the diaspora in a joint development effort," he said.

As he explained, the initiative aims to create transparent investment mechanisms and mutual trust, involving financial institutions, diaspora associations and public entities, in order to channel part of the remittances into projects with a community, business and social impact.

However, the expert argues that it's necessary to go beyond the welfare dimension, taking advantage of the potential of emigrant communities to boost strategic sectors such as energy, tourism, housing, innovation and the digital economy.

Miguel Sousa also recalled that remittances represent the individual savings of emigrants, which must be protected from bank speculation and managed transparently, guaranteeing traceability and national sovereignty.

"The country must have a sovereign perception of these savings, because they are fundamental resources for the economy", he said.

The consultant explained that a large part of the population linked to remittances does not have access to traditional bank credit and often resorts to microfinance institutions with rates of over 25%, which are unviable for local businesses.

To get around this situation, Miguel Sousa proposes that remittances be integrated into the formal financial system, enabling more Cape Verdeans to access credit and invest in the country.

He also pointed out that the volume of remittances, which represents around 25% of GDP, makes it possible to create national financial instruments, such as investment or development banks, which would leverage the resources of the diaspora to support local projects and promote sustainable growth in the economy.

"Considering remittances as a public good with a private base, which is a new economic concept, will make it possible to transform the governance of these contributions, promoting equal access to credit and strengthening national development," he stressed.

Miguel Sousa also clarified that the proposal does not replace the traditional role of remittances in supporting families, but adds a structuring economic dimension, promoting financial inclusion, entrepreneurship and investment opportunities.

He also stressed that the issue should be on the agenda of public policies aimed at the diaspora, advocating a broad national debate involving the government, the private sector, financial institutions and emigrant communities, with a view to defining a model adapted to the Cape Verdean reality.

"It is essential to transform the solidarity of the diaspora into a development asset, combining public policies with modern and sustainable financial instruments," concluded Miguel Sousa, arguing that the issue should be on the strategic agenda of the government and the diaspora.

Inforpress/End